The major reason for voiding and re-issuing an invoice as opposed to issuing a credit memo is to keep your operational data accurate. I'll cover a few in this introduction and you can likely deduce which method best suits you based on these examples. credit memo may seem very similar, they should be used in different cases.

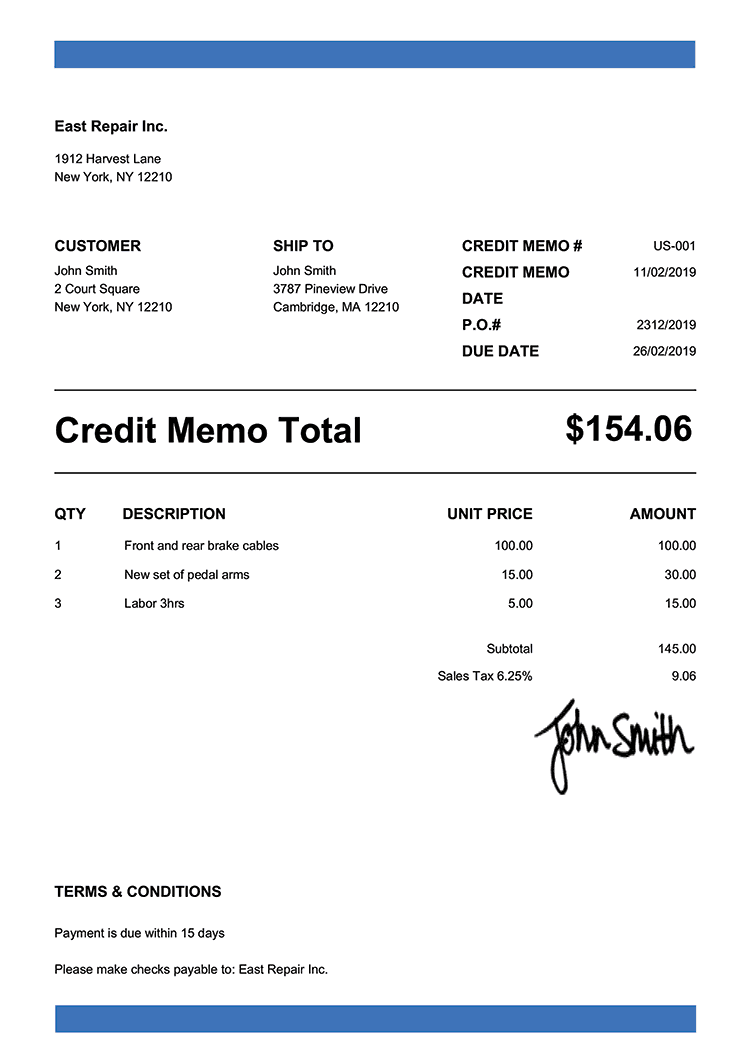

A second way is to create a credit memo and send that to the client. One way is to void the original invoice and reissue a corrected one. Utilizing a template is wise and can help to ensure that all required information is provided to both sides of the transaction.There are two ways in Projector to credit money back to a client.

In this case, the dealer would be wise to issue a credit memo to correct the change in their inventory, while also ensuring that the customer receives replacements or repayment for their losses.Īll in all, there is truly an abundance of effective uses for the credit memo. If this happens, the client may reject the item and have it resent to the dealer. Rejected Or Damaged Goods – In some cases, products can be damaged during shipping or they may be faulty.In this type of scenario, the business would confirm the shortfall of the single unit and would use the document to either confirm the shipment of another or the repayment of the cost. Insufficient Quantity – If the customer calls and complains about ordering 10 units, while only receiving 9, the business will use a credit memo to confirm and rectify the mistake.

The customer was overbilled – If the customer is overbilled, the credit note will be delivered to reflect the changes and show that the customer received the appropriate refunded amount.Below, you will discover some of the events, which call for the utilization of a credit memo template. The business primarily sends out this document, when a mistake is made on their end. Now, it is time to learn about the innumerable uses of a credit memo. The specifics will depend on the seller or bank in question. Any issues, which brought about the need for the memoĪgain, these details may or may not be provided.References to the buyer’s original invoice.A list of purchased goods and services, as well as prices for each.Below, you will discover some of the precise details that may be found on this document. A bank would obviously list different information than a retail establishment.

What needs to be provided on a credit memo truly depends on the scenario in question. At the same time, banks commonly utilize these documents, when making depositors aware of changes made to their balances. The credit memo may be in the same value as the original invoice or it may be slightly lower depending on the specific scenario in question. The credit memo, which is also referred to as a credit memorandum or note, is a commercial document that is primarily provided by the seller to the buyer of a transaction. Although they both can effectively show the customer how much they’re spending and have spent, the credit memo is helpful in some precise circumstances, which will be explored in greater detail below. A statement is actually a compilation of several different credit memos or invoices. Credit memos are actually invoices and are utilized to list products and services, which were purchasing in a singular transaction. What precisely is a credit memo and how is it any different from a statement? You’ll be able to find out below!įirst and foremost, it is vital to realize that statements and credit memos are not one in the same. This is where a credit memo template could prove to be immensely beneficial. These individuals need to be well prepared to deal with these events, before they can arise. At one point in time, everything could be going swell, but an unexpected phone call could immediately flip things upside down. Business owners face an abundance of uncertainties on a daily basis.

0 kommentar(er)

0 kommentar(er)